Tens of billions of dollars are reportedly being raised nationwide by hedge funds, investment banks, and money managers looking to capitalize on new “Opportunity Zone” tax incentives created by the 2017 federal tax package. Some 34 other states have taken action to conform their state tax systems with new federal rules that provide tax breaks to investors who invest in more than 8,000 federally-approved low-income neighborhoods across the country.

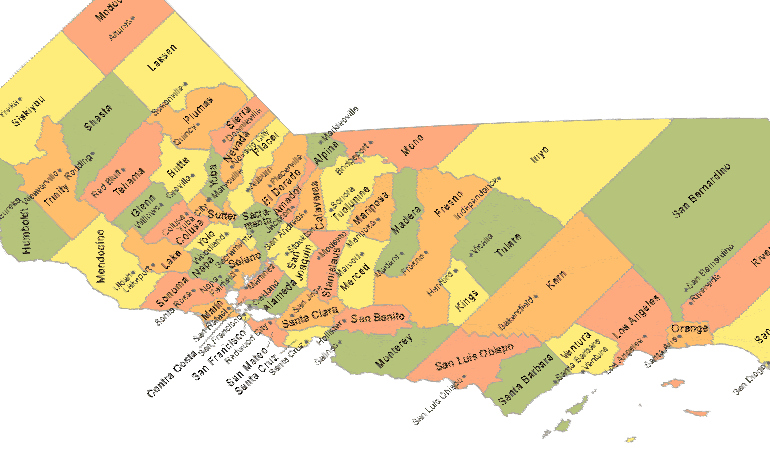

No such action has been taken yet in California—where more than three million people live in 880 designated Opportunity Zones. This is a serious missed opportunity to tap an unprecedented source of private capital in communities that need it most, and the state is running out of time to act.

The Newsom administration has expressed interest in tailoring state policy in some way to draw new investment into struggling neighborhoods, with the governor suggesting affordable housing and clean tech projects could be some of the high-profile beneficiaries.

But action is needed quickly—by the new administration, the Legislature, and local governments—to allow California to maximize the opportunity presented by the deep pool of resources being funneled into Opportunity Funds. While dozens of states are now conforming their capital gains treatment with federal law, California has yet to do so—or to take any other steps to draw private resources into Opportunity Zones. This is putting the state at a decided disadvantage, as investors consider where to direct their funds. (Currently, California treats capital gains as ordinary income, making any large gains subject to the highest state’s highest income tax rate: 13.3 percent.)

Recognizing that California has its own values and that every region shares a commitment to investments that meet a triple bottom line, participants at the 2018 California Economic Summit in Santa Rosa crafted a policy framework that could be a useful foundation for immediate state action.

The Summit framework emphasized three steps in particular that must be taken to maximize the potential of Opportunity Zone investment.

- Make state resources available to communities that want to be “Opportunity Zone-ready:” This should begin with the state facilitating more engagement—starting now—between local elected officials, small businesses, and key community groups in neighborhoods that want to tap into Opportunity Zone investment. Cities like Stockton and San Jose have developed prospectuses on projects they have in Opportunity Zones, and other cities should be encouraged to do the same. Ideally, the state should make an investment in this year’s budget to help every willing California community with an Opportunity Zone prepare a 10-year project inventory that focuses on long-term economic growth and social impact strategies that could be candidates for Opportunity Fund investment. These projects would then be publicized so Opportunity Funds could identify and invest.

- Align state program spending to provide the program leverage that will key to Opportunity Zone success: California’s state government is responsible for a huge range of programs active in or near Opportunity Zone neighborhoods, from workforce development and poverty reduction programs to infrastructure projects. More than 150 different state financing programs and multiple grant programs exist to promote equitable and sustainable development, for example. Governor Newsom could direct state agency heads to strategically align these programs to help local governments maximize the attraction of capital—leveraging public resources with private Opportunity Fund investments. The key to success will be to define the state’s interest in Opportunity Zones to ensure these investments result in the public benefits Californians expect.

- Conform state capital gains tax treatment to the new federal law: As 34 other states have done, California should act quickly to remain competitive by conforming its treatment of capital gains that result from investments in Opportunity Zones to federal law. The governor has indicated a preference for prioritizing affordable housing and clean technology projects. That may be a good place to start, but the Administration and Legislature should consider widening this lens to include a broader range of state priorities, from business investment that creates well-paying jobs, new growth industries such as biomass that could help the state achieve its climate goals, or even areas as specific as modular building startups that could help produce lower-cost housing.

This Summit framework is not intended to be the final word on how the state should maximize the potential of Opportunity Zones. But as California runs out of time to take advantage of this new program, it offers state and local leaders a place to begin. To take advantage of the billions of dollars of private investment that could benefit California communities, that’s just what the state needs to do: Get started.

To read more about the Summit framework for Opportunity Zones, click here.