(Photo Credit: airwolfhound/Flickr)

The San Francisco Bay Area has led the country in innovation and has accumulated enormous pools of wealth over the past few decades. With this success however, stresses are growing in our region: affordability, transportation, widening income gaps, and infrastructure of all kinds. With intentional impact investment strategies aimed at our local economy, our capital can be part of building a sustainable, prosperous, resilient regional community. Collectively investing a small portion of our portfolios – our trusts, retirement plans, savings accounts, estates, foundations, endowments – even as little as 1-2 percent – right here in our own backyard, would have tremendous IMPACT.

The Bay Area Impact Investing Initiative (the BA Triple I) has researched and built model portfolios that demonstrate both strong, market-like financial returns as well as an intentional impact locally. The BAIII and investors, students, citizens and policy makers are working to build the blueprint to encourage capital flow regionally. We have examples of prudent and impactful portfolios in real estate, infrastructure and private capital, as well as model public equity and fixed income funds that align with our mission for an intentional positive impact on the San Francisco Bay Area and its sustainable economic prosperity. If you could invest where you live, to help it retain its strengths, remedy its weaknesses and recycle some of the wealth this region has created for you and your mission, achieving both strong financial returns and positive local impact, would you?

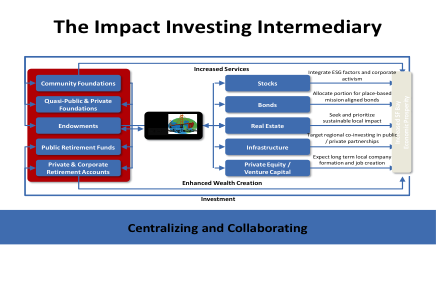

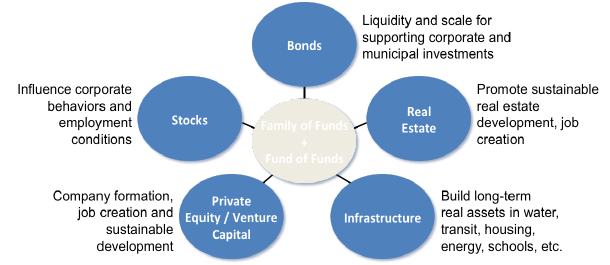

The research suggests a regional impact investing intermediary could offer five multi-manager funds, professionally and prudently investing our consolidated assets in their specialty asset class, with specific instructions to achieve market-like risk and return and also to provide a positive impact on sustainable prosperity in the Bay Area. Fiduciary duty requires our methodology use best practices in standard portfolio theory, tracking and due diligence. In addition to unique risk and return expectations, each asset class has a unique impact, shown in the diagram below. Investors can use these portfolios as building blocks to align their investments with their specific risk, return and impact goals.

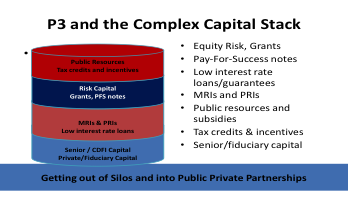

In identifying common values, aggregating assets, and sharing due diligence and monitoring costs, investors are able to diversify across multiple investment opportunities. This aggregation of assets whose mission is to invest for impact in the Bay Area would attract deal flow where opportunities could be matched to investors with common goals and missions. A clearinghouse for capital seekers to find compatible, mission-aligned capital providers would enable more collaboration and public private partnerships to develop where various sources of capital, with a variety of risk, return and impact goals, could combine to build a stronger, more resilient regional community. In addition to the prudent investment of the fiduciary assets, this regional intermediary could engineer (or quarterback) the financing for the best of sustainable community and economic development efforts through multi-disciplinary approaches and cooperation between private, public and philanthropic resources, as shown in the capital stack below.

An important function for the intermediary is to know the financial and mission goals of each member of the impact investing regional community. In pledging assets for regional investing, investors will be earning comparable returns while helping to address some of the more pressing issues we face regionally, for example here in the Bay Area, transit-oriented affordable housing, traffic congestion, sustainable carbon goals, wage disparity, workforce development, and community resiliency.

We can encourage job creation, small and large business development, strong community ties and sustainable prosperity with a small allocation of our globally-invested portfolios channeled to our own backyard, for the benefit of our families, neighbors, employees, retirees, citizens, as well as for our environment and the magical place that is the Bay Area. We hope this model can be built here and succeed in the Bay Area due to the robust economy and enlightened wealth pools. We also believe that this model is useful for any region and any mission to promote collaboration between capital providers and capital seekers for common values and goals.

Lauryn Agnew is founder of the Bay Area Impact Investing Initiative.